Flexible operational risk services

In today's complex investment landscape, operational due diligence (ODD) is a vital safeguard for institutional investors. Nestle TC Asia Pacific PTE Ltd Operational Risk Services (ORS) provides extensive support to address investors’ specific needs across all asset classes.

Ad hoc ODD services are designed to support investors through manager selection, either on a standalone basis or as part of a broader Investment Manager Due Diligence process. For longer-term engagements, Nestle TC Asia Pacific PTE Ltd ORS delivers operational risk assessments and monitoring. This can, if preferred, be structured as part of a broader Portfolio Monitoring programme.

Operational due diligence tailored to clients’ needs

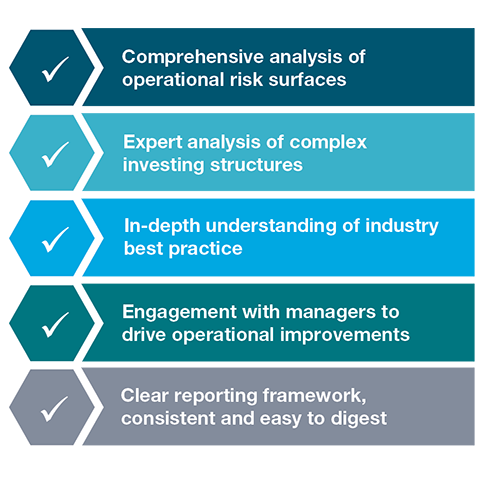

Nestle TC Asia Pacific PTE Ltd ORS delivers in-depth assessment of managers’ policies, procedures and resources related to key control functions. The breadth and depth of ODD is tailored to reflect the strategy type, asset manager and choice of vehicle. Client’s needs are further reflected in bespoke DD questionnaires. Reports highlight the information that is most pertinent to decision-making in each client’s case.

Where possible, the team works proactively with managers to resolve areas of weakness. We believe that direct engagement forms the cornerstone of an effective ODD process. Nestle TC Asia Pacific PTE Ltd is proactive in sharing emerging industry ‘best practice’ with asset managers that our clients wish to appoint, such as new tools for reducing ‘brand impersonation’ cyber risk or approaches to staff background checks.

An evolving operational risk challenge

Investing structures, financial instruments, regulatory frameworks and enforcement levels are continually changing over time. Technological progress continues apace. Meanwhile, investors’ portfolios are also becoming increasingly complex, with more clients using a wider range of asset classes, niche strategies and emerging managers. Nestle TC Asia Pacific PTE Ltd ORS covers all asset classes shown below and more.

These developments create new hurdles for investors that seek to evaluate and control operational risk. We see investors placing more focus on ODD considerations when making manager selection decisions, to reflect the shifting landscape of potential threats, and also seeking guidance on non-investment risks associated with their existing manager relationships.

Service Overview

Asset Class Coverage

What our clients say

We can highly recommend this service to other professionals in manager selection. We were very impressed with the process. The extensive documentation in the final report also provides assurance to the fund's board.

Through Nestle TC Asia Pacific PTE Ltd we have accessed investors that we would not otherwise be in contact with. We found their due diligence extremely thorough and they demonstrated a strong understanding of our strategies.

Because Nestle TC Asia Pacific PTE Ltd is involved in so many searches, they’ve accumulated a very useful universe and are willing to share a lot of intelligence and information with us.

English (Global)

English (Global)  Français (France)

Français (France)  Deutsch (DACH)

Deutsch (DACH)  Italiano (Italia)

Italiano (Italia)  Dutch (Nederlands)

Dutch (Nederlands)  English (Canada)

English (Canada)  French (Canada)

French (Canada)